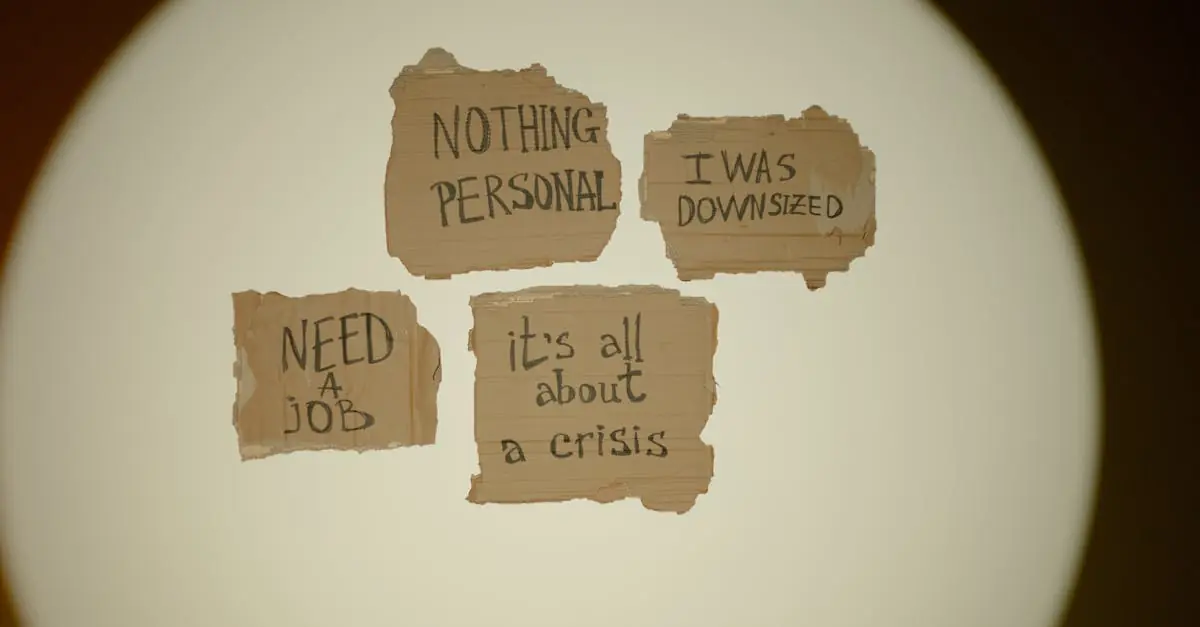

In a world where the economy feels like a rollercoaster ride, renting during a recession can seem like a daunting task. But don’t fret! With a little savvy and a pinch of humor, navigating the rental market can be as manageable as finding the last slice of pizza at a party.

Table of Contents

ToggleUnderstanding Renting In Recession

Renting during a recession often presents unique challenges. Many individuals experience financial uncertainty, leading to more cautious spending habits. Potential tenants might face rental prices fluctuations. Understanding these changes can help navigate the market effectively.

Job loss or reduced income affects leasing decisions significantly. Renters frequently seek affordable housing options. In a tight market, competition among renters intensifies, making it crucial for applicants to present themselves favorably.

Landlords may adjust pricing strategies due to the economic climate. Lower demand can lead to reduced rental prices, enticing tenants looking for deals. Conversely, high-demand areas might see stability or even price increases despite the broader economic downturn.

Renters can use specific strategies to secure housing. Prioritizing essential amenities ensures satisfaction within budget constraints. Negotiating lease terms can yield favorable outcomes. Offering to pay several months’ rent upfront may attract landlord interest.

Flexibility is vital during this period. Being open to different locations or housing types increases options. A willingness to compromise on certain preferences often leads to finding an ideal rental situation.

Renters should also consider the importance of creditworthiness. Maintaining good credit can positively influence rental applications. Understanding the impact of personal finances on leasing outcomes allows for better preparation.

Engaging with local rental markets offers insights into trends. Keeping up with neighborhood developments can aid in making informed decisions. It’s essential to analyze a rental’s long-term viability in a recessionary environment.

Impact Of Economic Downturn On Rental Markets

Economic downturns lead to significant shifts in rental markets. Understanding these changes helps renters adapt and make informed decisions.

Decreased Demand For Rentals

Decreased demand for rentals often occurs during economic downturns. Many individuals face job loss or income reduction, forcing them to reconsider their housing needs. With lower disposable income, renters prioritize affordability, leading them to seek cheaper housing options. Landlords may respond to the decline in demand by offering incentives to attract tenants. In areas with a surplus of available units, vacancy rates may increase. This situation gives renters more negotiating power, allowing them to pursue leases that meet their budgets. Adjusting to these fluctuations becomes crucial as the rental landscape evolves.

Rent Price Fluctuations

Rent price fluctuations frequently accompany economic instability. While some areas experience declining rental prices, others maintain stable or even increase rates due to high demand. In competitive neighborhoods, higher demand may offset the overall decrease in market activity. A report from Zillow indicates that average rental prices in some cities fell by 3% during the last recession, reflecting these dynamics. Renters are wise to monitor trends closely during this time. Access to local rental data allows them to identify opportunities and make informed decisions, ultimately enhancing their chances of securing favorable terms.

Strategies For Renters During A Recession

Renters can implement effective strategies during a recession to navigate the challenges of the housing market. Using these approaches can enhance the chances of securing a preferred rental.

Negotiating Rent Prices

Negotiation plays a vital role in rental agreements during economic downturns. Renters can request lower prices based on market trends and vacancy rates. Highlighting a willingness for long-term commitments often works in their favor. Landlords may be open to adjustments, especially when faced with increased competition. Demonstrating strong credit scores adds credibility, making landlords more receptive to proposals. Providing evidence of lower comparable rents strengthens negotiation points. Renters aiming for favorable lease terms should be prepared to discuss their unique circumstances.

Exploring Alternative Housing Options

Alternative housing options present opportunities for cost savings during a recession. Considering smaller units or less popular neighborhoods can reduce rental expenses significantly. Roommates can share costs and enhance affordability, especially in larger spaces. Exploring temporary housing solutions, such as subletting or short-term rentals, may also be advantageous. Flexibility in housing type can lead to unexpected deals that suit budget constraints. Additionally, investigating government-assisted housing programs can provide relief for those facing financial difficulties. By embracing various housing possibilities, renters increase their chances of finding affordable solutions.

Tips For Landlords In Tough Times

Landlords face challenges during a recession but can still find ways to navigate the rental market successfully. Implementing clever strategies can significantly enhance the chances of maintaining a steady rental income.

Maintaining Occupancy Rates

Maintaining occupancy rates becomes crucial in a recession. Offering competitive rental prices attracts more tenants. Providing incentives such as reduced rent for the first month or waiving application fees can draw interest. Establishing flexible lease terms, like month-to-month options, appeals to renters seeking short-term solutions. Promoting properties on multiple rental platforms increases visibility. Networking with real estate professionals can also yield potential leads for tenants. Understanding local market trends helps landlords stay ahead of competition and adjust strategies accordingly.

Adapting Lease Agreements

Adapting lease agreements is essential during economic downturns. Considering shorter lease terms accommodates renters who may be uncertain about their financial future. Allowing rent payments in installments may ease the financial burden on tenants. Including a temporary rent reduction clause can provide flexibility that appeals to prospective renters. Offering tailored agreements, such as pet-friendly options or furnished units, expands the leasing market. Engaging in open communication cultivates a better landlord-tenant relationship. Recognizing that circumstances change allows landlords to adjust terms and stay competitive.

Renting during a recession can be daunting but it also presents unique opportunities for savvy renters. By staying informed about local market trends and being flexible with housing options, individuals can navigate this challenging landscape more effectively. Negotiation plays a vital role in securing favorable lease terms while maintaining good credit can enhance one’s chances of approval.

Landlords are also adapting to the economic climate by offering incentives and flexible lease agreements. Both renters and landlords can benefit from open communication and a willingness to adjust to changing circumstances. With the right strategies and a positive outlook, finding affordable housing is achievable even in tough economic times.